Angel One Share Price 2024-Buy or Sell??

The financial landscape witnessed a sharp turn as Angel One Ltd, a prominent broking firm, faced a tumultuous journey with its shares plummeting by 13% post Q3 results. In this Angel One Share Price 2024 blog, we delve into the reasons behind this decline, the company’s financial performance, and insights from Motilal Oswal, shedding light on the intricate details of the situation.

The Q3 Earnings Plunge

Angel One Ltd faced a significant setback as its Q3 profits fell by 14% sequentially, primarily attributed to higher growth in cash segment orders, modifications in cash intraday tariff structures, and increased operational expenses due to client acquisition. The profit for the quarter stood at Rs 260.30 crore, a notable drop from Rs 304.50 crore in the previous quarter. Sales, however, managed to eke out a 1% increase to Rs 1,060.80 crore despite the challenging market conditions.

Year-on-Year Perspective

On a year-on-year basis, Angel One’s profit after tax showed a 14% increase, although it fell short of Motilal Oswal’s estimates by 17%. The expenses for the quarter also surpassed expectations, with admin and other expenses rising by 17%, contributing to the overall decline in the share price.

Dividends and Fundraising Initiatives

Despite the challenges, Angel One’s board declared a third interim dividend for FY24 at Rs 12.70 per share, showcasing a commitment to shareholders. Additionally, the company approved raising funds through the issuance of non-convertible debentures, amounting to Rs 500 crore, indicating strategic financial planning.

Market Share and Financialization Trends

Angel One’s F&O market share improved to 26.8%, reflecting a positive trend from 26.2% in Q2FY24. The company demonstrated resilience in the face of market challenges, with F&O average daily turnover growing 22% QoQ and an impressive 151% YoY. Motilal Oswal emphasized Angel One as a perfect play on the financialization of savings and digitization.

Motilal Oswal’s Analysis and Future Prospects

Motilal Oswal acknowledged Angel One’s strong performance in 3QFY24 and its strategic investments in technology. However, concerns were raised regarding the slowing client addition trajectory and activation rate. Motilal Oswal expressed intentions to review estimates and targets post a scheduled concall on January 16, underlining the dynamic nature of the market.

Stock Market Response

The market responded swiftly to Angel One’s Q3FY24 earnings, with the share price witnessing a 12.76% decline, reaching a low of Rs 3,380 on BSE. This abrupt dip raised eyebrows and prompted investors to reevaluate their positions.

Angel One’s Remarkable Q3FY24 Achievements: Angel One Share Price 2024

Despite the challenging financial landscape, Angel One reported several notable achievements in Q3FY24. The company achieved its highest-ever client addition, welcoming 2.5 million clients, bringing the total client base to 19.5 million. The number of orders increased by 54% YoY, and the average daily turnover surged to Rs 36 trillion, showcasing resilience and adaptability in a competitive market.

Leadership Insights

Dinesh Thakkar, Chairman & Managing Director of Angel One, highlighted the company’s commitment to offering clients suitable products through data and technology. Process improvements, enhanced onboarding experiences, and unique features contributed to improved rankings in NPS, Playstore, and Appstore.

Share Price Volatility

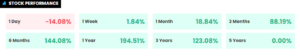

Despite posting impressive numbers for the December quarter, Angel One Share Price 2024 faced a steep decline, opening at Rs 3,500 and subsequently dropping to a two-week low of Rs 3,392 – a significant 12.5% decrease. However, it’s essential to note that since its listing in 2020, the company shares have consistently delivered strong returns.

The rollercoaster ride of Angel One share price 2024 reflects the intricacies of the financial market, influenced by both internal performance factors and broader market dynamics. As investors navigate these fluctuations, it becomes crucial to stay informed, consider expert opinions, and assess a company’s long-term potential amidst short-term challenges. In the world of finance, where uncertainties are the only certainty, strategic decision-making remains the key to success.