HDFC Bank Q3 Results 2024-What is it for you?

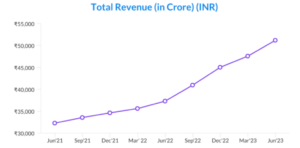

HDFC Bank, one of India’s leading private sector lenders, has recently announced its financial results for the third quarter of fiscal year 2024-the HDFC Bank Q3 Results 2024. The bank reported robust performance, with a 34% jump in profit, meeting the expectations of the market. In this blog post, we will delve into the key takeaways from HDFC Bank Q3 Results 2024, exploring factors such as profit, net interest income, loan growth, deposits, and more.

Profit Soars to Rs 16,373 Crore

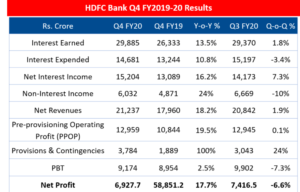

HDFC Bank Q3 Results 2024 reported a stellar performance in Q3, with a 33.54% YoY rise in standalone net profit, reaching Rs 16,372.54 crore. This figure aligns closely with the Street’s expectations, showcasing the bank’s resilience and sound financial management.

Net Interest Income and Pre-Provision Operating Profit

The net interest income (NII) for the quarter witnessed a substantial YoY increase of 23.9%, totaling Rs 28,470 crore. Although slightly below analyst estimates of 25%, this growth emphasizes the bank’s strong position in interest earnings. Moreover, pre-provision operating profit surged by 24.3% to around Rs 23,650 crore.

Provisions and Asset Quality

Provisions for the quarter rose to about Rs 4,220 crore, reflecting the bank’s cautious approach to risk management. The gross non-performing assets (NPAs) were at 1.26% of gross advances, showcasing an improvement from the previous quarter. Net NPAs stood at 0.31%, indicating a prudent handling of asset quality.

Revenue Diversity

Non-interest revenue for Q3 2023 reached approximately Rs 11,140 crore, demonstrating a significant increase from Rs 8,500 crore in the corresponding quarter of the previous year. Among the components of other income, fees & commissions contributed Rs 6,940 crore, foreign exchange & derivatives revenue was at Rs 1,210 crore, and net trading and mark-to-market gain stood at Rs 1,470 crore.

Operational Efficiency and Expenses

HDFC Bank’s operating expenses increased by 28.1% to Rs 15,960 crore compared to the same quarter last year. The cost-to-income ratio for the quarter was at 40.3%, indicating operational efficiency even amidst the rising costs.

Loan Growth and Distribution Network

The bank witnessed robust growth in domestic retail loans, which surged by an impressive 111.1%. Commercial and rural banking loans grew by 31.4%, and corporate and other wholesale loans increased by 11.2%. As of December 31, 2023, HDFC Bank’s distribution network included 8,091 branches and 20,688 ATMs across 3,872 cities.

Deposits and Capital Adequacy

HDFC Bank’s total deposits grew by 27.7% to Rs 28.47 lakh crore in Q3 of FY24. The current account and savings account (CASA) deposits witnessed a 9.5% growth, with savings account deposits at Rs 5.79 lakh crore and current account deposits at Rs 2.58 lakh crore. The total Capital Adequacy Ratio (CAR) stood at a robust 18.4%, well above the regulatory requirement of 11.7%.

Earnings for the Nine Months and Market Response

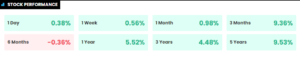

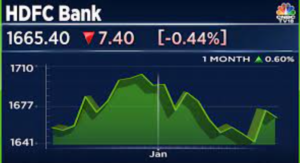

Looking beyond the quarterly results, HDFC Bank’s financial performance over the nine months ending December 31, 2023, paints a robust picture. The total income for this period reached ₹217,940 crore, a substantial increase from ₹138,950 crore in the corresponding period of the previous year. Net revenue, comprising net interest income and other income, stood at ₹110,530 crore, showcasing the bank’s sustained growth trajectory. The market responded positively to these results, with HDFC Bank’s shares ending 0.42% higher at ₹1,678.95 on the BSE, underlining investor confidence in the bank’s financial health and strategic direction.

Capital Adequacy and Regulatory Compliance

An essential aspect of a bank’s stability is its adherence to regulatory guidelines. HDFC Bank not only surpassed the regulatory requirement with a total Capital Adequacy Ratio (CAR) of 18.4% but also maintained a Tier 1 CAR of 16.8% and a common equity Tier 1 capital ratio of 16.3% as of December 31, 2023.

In conclusion, HDFC Bank Q3 results 2024 present a comprehensive overview of its financial health and operational prowess. With a resilient profit margin, robust asset quality, and strategic growth in various loan segments, the bank remains a stalwart in the banking sector. The positive market response and adherence to regulatory standards further solidify HDFC Bank Q3 Results 2024 standing as a trustworthy and forward-thinking financial institution. As it navigates the evolving financial landscape, HDFC Bank’s proactive approach positions it to overcome challenges and continue its trajectory of success.