The Platinum Industries Initial Public Offering (Platinum Industries IPO Allotment Finalized ) has concluded with an overwhelming response from investors. As the bidding phase has drawn to a close, attention now turns to the allotment status of the Platinum Industries IPO.

Platinum Industries IPO Allotment Date

The IPO, valued at ₹235.32 crores, opened on February 27 and closed on February 29. Today, on March 1, the allotment process for Platinum Industries IPO has been finalized.

Checking Allotment Status Online

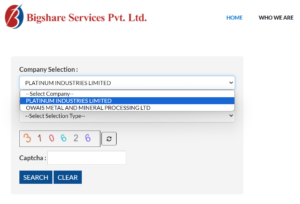

Investors who have applied for the Platinum Industries IPO can conveniently check their allotment status online. This status can be verified on the IPO registrar portal, managed by Bigshare Services Pvt Ltd, or alternatively, on the BSE website.

Steps to Check Allotment Status-Platinum Industries IPO Allotment Finalized

For those eager to check their allotment status, follow these simple steps:

- Visit the official website of the IPO registrar, Bigshare Services Pvt Ltd.

- Select “Platinum Industries Limited” from the provided options.

- Choose the appropriate identification method: Application No/CAF No, Beneficiary ID, or PAN.

- Enter the required details.

- Complete the captcha verification.

- Click on ‘Search’ to retrieve your allotment status.

Alternatively, follow these steps to check allotment status on BSE’s official website-Platinum Industries IPO Allotment Finalized

- Visit the BSE website.

- Select “Platinum Industries IPO” from the dropdown menu.

- Provide your Application number or PAN.

- Complete the captcha verification.

- Click on ‘Submit’ to view your allotment status.

Platinum Industries IPO GMP Today

The Grey Market Premium (GMP) for Platinum Industries IPO stands strong at ₹88 per share. This indicates a premium of 51.46% over the IPO price, with shares trading at ₹259 apiece in the grey market.

Platinum Industries IPO Subscription Status

The IPO has garnered significant attention, with an overall subscription of 99.03 times. Notably, the retail category witnessed a subscription of 50.99 times, while the Qualified Institutional Buyers’ (QIB) and Non-Institutional Investors’ (NII) categories were oversubscribed by 151.00 times and 141.83 times, respectively.

Platinum Industries IPO Details as Platinum Industries IPO Allotment Finalized

The IPO, which commenced on February 27 and concluded on February 29, raised ₹235.32 crores through a fresh issue of 1.38 crore equity shares. The price band was set at ₹162 to ₹171 per share, with a minimum lot size of 87 shares.

With the allotment process finalized, investors eagerly await the listing of Platinum Industries IPO on Tuesday, March 5, on both BSE and NSE. Unistone Capital Pvt Ltd serves as the book running lead manager, while Bigshare Services Pvt Ltd is the IPO registrar, facilitating a seamless allotment process for investors-Platinum Industries IPO Allotment Finalized .