Table of Contents

HDFC Bank Share Price 2024 vs ICICI – is it a Must-Own?

Margins Standoff

HDFC Bank and ICICI Bank find themselves in a tight race as both grapple with margin challenges. A closer look reveals nuances that set them apart on the path to financial prowess.

Struggles and Strengths of HDFC Bank

In the arena of deposit growth and Liquidity Coverage Ratio (LCR), HDFC Bank faces headwinds. Despite this, InCred Equities points out that HDFC Bank’s potential deposit rate hikes could dictate market dynamics, leveraging its wider branch network for unsecured retail and SME/MSME loans.

The Operating Leverage Advantage

As both banks navigate margin pressures, InCred Equities sees a silver lining for HDFC Bank. The anticipation of improving operating leverage, driven by the expansion of large-ticket mortgage loans, positions HDFC Bank favorably in terms of growth and profitability.

ICICI Bank’s Balanced Growth

Contrarily, Nuvama underscores ICICI Bank’s consistent delivery of balanced and granular growth over the past two years. Bolstered by a robust balance sheet, superior net interest margin (NIM), and ample liquidity, ICICI Bank emerges as a resilient player in the sector.

The ‘Must-Own’ Proposition

In a sector grappling with deposit constraints, Nuvama makes a compelling case for ICICI Bank as a “must-own stock.” Its resilience in the face of industry challenges, coupled with a 10% premium justified by relative earnings performance, positions ICICI Bank as a low-risk play on the Indian macroeconomic landscape.

Target Prices and Expert Opinions

Nomura India and Motilal Oswal Securities align with the consensus, labeling ICICI Bank as their preferred banking pick. However, Kotak cautions that ICICI Bank must sustain superior returns to justify its peak valuation among large banks.

Decoding the Future

As investors weigh the pros and cons of HDFC Bank Share Price 2024 and ICICI Bank, the road ahead seems paved with opportunities and challenges. With differing perspectives from analysts, the journey towards deciding the ‘must-own‘ stock leads to contrasting conclusions. While HDFC Bank holds promise with its growth-oriented strategy, ICICI Bank’s resilience and balance might just make it the safer bet in an uncertain economic landscape.

In the spotlight of 2024, HDFC Bank Share Price 2024 and ICICI Bank face off, each with its unique strengths and challenges. HDFC Bank Share Price 2024, struggling with deposit growth and LCR concerns, eyes potential hikes to maintain market share. In contrast, ICICI Bank stands resilient, delivering balanced growth with a strong balance sheet, favorable NIM, and ample liquidity.

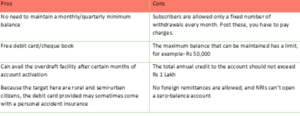

HDFC’s Pros:

- Deposit Struggles: HDFC grapples with deposit growth and weak LCR.

- Operating Leverage: Anticipated improvement in operating leverage boosts HDFC’s growth and profitability prospects.

ICICI’s Strengths:

- Balanced Growth: ICICI consistently delivers granular growth with a robust balance sheet.

- Must-Own Stock: Nuvama asserts that ICICI Bank is a ‘must-own stock’ in a sector constrained by deposits, citing its resilience and low-risk position.

Analyst Views:

- InCred Equities: Favors HDFC due to potential deposit rate hikes and superior access to unsecured loans.

- Nuvama: Praises ICICI’s balanced growth and sees it as a ‘must-own’ stock in a challenging sector.

- Elara Securities: Highlights ICICI as a clean play on best-in-class RoA, suggesting a premium justified by relative earnings.

Target Prices:

- ICICI Bank: Average target price of Rs 1,210, suggesting a 16% potential upside.

- HDFC Bank: Average target price of Rs 1,966, indicating a 35% upside.

Expert Consensus:

- Nomura India & Motilal Oswal Securities: Prefer ICICI Bank as their top banking pick.

- Kotak: Cautions that ICICI Bank must deliver sustainable superior returns to justify its peak valuation.

As investors navigate the financial landscape, the choice between HDFC Bank and ICICI Bank is nuanced, with each offering a unique value proposition. While HDFC holds promise with its growth-oriented strategy, ICICI Bank’s resilience and balance position it as a ‘must-own’ stock in uncertain economic times. The future, laden with opportunities and challenges, awaits investors’ strategic decisions.-HDFC Bank Share Price 2024