Table of Contents

The Role of Insurance in Financial Planning for Beginners

When it comes to securing your financial future, insurance plays a crucial role a beginner, it’s essential to understand the significance of insurance in financial planning how it can help you achieve long-term financial security and stability. This comprehensive guide will explore the various aspects of insurance and its integration into a beginner’s financial plan, ensuring that you have the knowledge and tools to make informed decisions about your financial well-being and protection.

What is Financial Planning?

Financial planning entails setting and managing financial goals to achieve desired outcomes. It involves creating budgets, determining savings strategies, and making investment decisions. The primary objective of financial planning is to attain financial stability and meet short-term and long-term financial requirements.

Why Is Insurance Important in Financial Planning?

Insurance forms a critical pillar of comprehensive financial planning. It offers protection against financial risks and unexpected expenses, providing a safety net for you and your loved ones in times of need. By incorporating insurance in your financial plan, you mitigate the damaging impacts of unforeseen events and secure your financial future, maintaining peace of mind and stability.

Types of Insurance Coverage for Beginners

Health Insurance

Health insurance covers medical expenses, protecting you from high healthcare costs. It provides coverage for doctor visits, hospital stays, prescription medications, and preventive care. With health insurance, you can ensure that unexpected medical bills do not derail your finances.

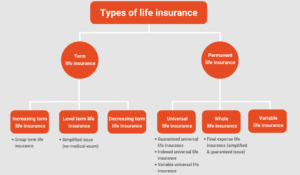

Life Insurance

Life insurance safeguards your family’s financial well-being in the event of your untimely death. It provides a lump sum payment, known as the death benefit, to your beneficiaries. This financial support can help cover funeral expenses, day-to-day living costs, and future financial needs, offering your loved ones much-needed stability during challenging times.

Disability Insurance

Disability insurance replaces a portion of your income if you become disabled and are unable to work temporarily or permanently. It is designed to protect your financial security by providing financial assistance while you recover or adjust to a new way of life due to a disability.

Property and Casualty Insurance

Property and casualty insurance protects your assets and possessions from damage or loss due to unforeseen events such as natural disasters, fire, theft, or accidents. This includes homeowner’s or renter’s insurance, auto insurance, and other forms of property insurance.

How to Choose the Right Insurance Policies for Beginners

Assessing Your Needs and Risks

Before selecting insurance policies, it’s important to assess your specific needs and risks. Consider factors such as your age, health condition, family situation, income, and financial goals. This evaluation will help you determine the type and amount of coverage required to adequately protect yourself and your loved ones.

Understanding Insurance Policies

To make informed decisions, familiarize yourself with the basics of insurance policies. Read the fine print, including coverage limits, exclusions, deductibles, and premium costs. Consider seeking guidance from insurance professionals or financial advisors who can help you navigate through complex terminology and policy details.

Evaluating Insurance Providers

When choosing insurance policies, it’s crucial to evaluate insurance providers based on their financial stability, customer service reputation, and claim settlement track record. Research and compare multiple insurers, read reviews, and check their ratings from independent rating agencies. This due diligence ensures that you choose a reliable provider backed by strong financial stability.

How Insurance Fits into Overall Financial Security

Insurance is a key component of overall financial security. It acts as a safety net, preserving your financial well-being when unexpected events occur. By integrating insurance into your financial plan, you protect yourself and your loved ones from potential financial hardships, ensuring the stability and longevity of your assets and savings.

Strategies for Incorporating Insurance in Financial Planning

Setting Financial Goals

Before purchasing insurance policies, establish clear financial goals. Determine what you want to achieve in the short term and long term. These goals will guide your insurance decisions, helping you choose the appropriate coverage that aligns with your aspirations.

Creating a Budget

To include insurance in your financial plan, create a comprehensive budget that accounts for insurance premiums. Allocate a specific portion of your income towards insurance coverage, ensuring that you have sufficient resources to pay for your policies without compromising other financial obligations.

Considering Long-Term Financial Planning

Insurance should be viewed as a long-term financial planning tool. As you progress in your career, experience significant life events, or face changes in your financial circumstances, regularly reassess your insurance needs and coverage to guarantee they continue to safeguard your financial well-being effectively.

Insurance Basics and Key Terms Every Beginner Should Know

To make informed decisions and fully understand insurance, familiarize yourself with key terms and concepts. Here are a few essential terms every insurance beginner should know:

- Deductible: The amount you must pay out of pocket before insurance coverage kicks in.

- Premium: The cost of insurance coverage, usually paid in monthly or annual installments.

- Policy Limit: The maximum amount an insurance policy will pay for a covered loss or claim.

- Claim: A request by the policyholder to the insurance company for compensation or coverage for a loss or event covered under the policy.

- Insurance Broker: An intermediary who represents multiple insurance companies and helps individuals find suitable coverage based on their needs.

- Coverage Exclusions: Specific events or circumstances that are not covered by an insurance policy.

The Benefits of Insurance Planning for Beginners

Insurance planning offers various benefits for beginners. Some advantages include:

- Financial Protection: Insurance safeguards your financial well-being by mitigating the impact of unforeseen events and protecting your assets.

- Peace of Mind: Knowing that you have adequate insurance coverage allows you to focus on your goals without constantly worrying about potential financial risks.

- Long-Term Financial Stability: By integrating insurance into your financial plan, you contribute to your long-term financial stability, minimizing disruptions caused by unexpected events.

- Enhanced Risk Management: Insurance helps you manage and minimize financial risks effectively, allowing you to pursue your financial goals with confidence.