Table of Contents

IRFC share price is rising: is a Multibagger on the Way?

In the dynamic world of stock markets, certain scrips manage to capture the spotlight, and Indian Railway Finance Corporation Ltd (IRFC) is currently stealing the show. In this blog, we’ll dive into the recent surge in IRFC share prices, explore the factors behind its remarkable performance, and understand what analysts predict for its future.

IRFC’s Remarkable Rally

IRFC shares witnessed an astonishing 19% surge, reaching a fresh one-year high of Rs 134.70. This market outperformer has exhibited an impressive 300% growth over the past year, making it a standout performer in the market.

Analyst Insights

Financial experts and analysts are optimistic about IRFC’s trajectory. Osho Krishan from Angel One points out the potential support levels around Rs 120-115, with an upward target of Rs 164. Shiju Koothupalakkal from Prabhudas Lilladher maintains a bullish stance, suggesting further upward moves with targets set at Rs 148-164.

Live share price of Indian Railway Finance Corporation provided by Stock Individuals

| Name | Latest Price | Change | % Change | 52W High | 52W Low | Mkt. Cap |

|---|---|---|---|---|---|---|

| Indian Railway Finance Corporation | 130.11 | 16.73 | 14.76% | 114.0 | 25.45 | 170034.33 |

| Mindspace Business Parks REIT | 330.0 | -0.59 | -0.18% | 364.3 | 290.36 | 19569.6 |

| Sanghvi Movers | 793.95 | -17.4 | -2.14% | 873.9 | 305.4 | 3436.85 |

| Dhunseri Investments | 1261.75 | -3.8 | -0.3% | 1400.0 | 562.0 | 769.31 |

| Silicon Rental Solutions | 223.0 | -13.5 | -5.71% | 268.9 | 123.3 | 229.07 |

Market Buzz and Sector Impact

The recent budget speculation has added fuel to the fire, propelling many railway-related stocks, including IRFC, to witness substantial gains. Vishal Periwal from IDBI Capital notes a sharp uptick in railway stocks, attributing it to anticipation of record allocations in the upcoming budget.

Trade Volumes and Market Capitalization

IRFC’s recent trading session saw a massive turnover, with 3.15 crore shares changing hands on BSE, far exceeding the two-week average volume of 1.09 crore shares. The turnover reached an impressive Rs 403.59 crore, contributing to an overall market capitalization of Rs 1,70,883.78 crore.

As of the latest update on January 15, 2024, IRFC closed at Rs 130.11, marking a 14.76% increase from the previous day. The stock’s journey throughout the day ranged from a low of Rs 116.20 to a high of Rs 134.70.

Peer Comparison and Sector Standing

Comparing IRFC with its peers, it stands out with a market capitalization of Rs 1,70,034.33 crore. Mindspace Business Parks REIT, Sanghvi Movers, Dhunseri Investments, and Silicon Rental Solutions, while prominent in their own right, lag behind IRFC in terms of market capitalization.

Technical Analysis

According to short-term and long-term trends, the technical analysis suggests a bullish outlook for IRFC. The stock’s simple moving average indicates a positive momentum, with values consistently on the rise over different time periods.

| Ratios | |

|---|---|

| Return on average equity – 5 year average | 14.66 |

| Net Income/employee – trailing 12 month | 1,47,99,02,000.00 |

| Revenue/employee – most recent fiscal year | 6,12,61,10,000.00 |

| Return on investment – most recent fiscal year | 1.41 |

| Return on average assets – most recent fiscal year | 1.35 |

| Receivables turnover – most recent fiscal year | 1.23 |

| Return on investment – trailing 12 month | 1.31 |

| Return on average assets – trailing 12 month | 1.26 |

| Inventory turnover – most recent fiscal year | – |

| Inventory turnover – trailing 12 month | – |

| Revenue/employee – trailing 12 month | 6,31,71,69,000.00 |

| Return on average assets – 5 year average | 1.39 |

| Net Income/employee – most recent fiscal year | 1,62,48,75,000.00 |

| Return on average equity – trailing 12 month | 13.30 |

| Receivables turnover – trailing 12 month | 2.61 |

| Asset turnover – most recent fiscal year | 0.05 |

| Asset turnover – trailing 12 month | 0.05 |

| Return on average equity – most recent fiscal year | 14.66 |

| Return on investment – 5 year average | 1.47 |

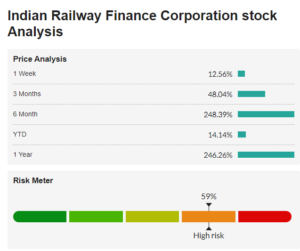

Price Fluctuations and Range

Throughout the day, IRFC experienced price fluctuations, starting from a low of Rs 116.20 to a high of Rs 134.70. Such fluctuations indicate the stock’s volatility and the active participation of traders in the market.

| Time Period | Price Analysis |

|---|---|

| 1 Week | 12.56% |

| 3 Months | 35.22% |

| 6 Months | 248.39% |

| YTD | 14.14% |

| 1 Year | 246.26% |

In conclusion, the recent surge in IRFC share prices is not just a blip on the radar but a significant market event. Analysts are optimistic about its future trajectory, and with the railway sector gaining attention in the budget anticipation, IRFC seems poised for further growth. However, investors should exercise caution and stay updated with the latest developments as stock markets are inherently unpredictable.