Table of Contents

How to Become a Successful Trader

Are you a beginner in the world of trading, eager to unlock the secrets to successful trades? Look no further! In this step-by-step guide, we will walk you through the essential strategies and techniques that will help you gain confidence and achieve success in trading.

Trading can be intimidating, especially for beginners. But with the right knowledge and approach, it can be a rewarding and profitable experience. This guide will cover everything from understanding market trends and analyzing charts to managing risk and developing a trading plan.

Whether you’re interested in stocks, forex, cryptocurrencies, or commodities, this guide will provide you with the foundational knowledge and practical tips you need to get started. We will demystify complex terms and concepts, making trading accessible to even the most novice of investors.

By the end of this guide, you’ll have a solid understanding of the key principles of successful trading and be equipped with the tools to make informed decisions. So, let’s embark on this trading journey together and unlock the secrets that will set you on the path to trading success.

Understanding the Basics of How to Become a Successful Trader

Trading is the process of buying and selling financial instruments, such as stocks, bonds, currencies, or commodities, with the aim of making a profit. Before diving into the world of trading, it’s important to understand the basics.

One fundamental concept in trading is the idea of supply and demand. Prices of financial instruments are determined by the interaction between buyers and sellers in the market. When there are more buyers than sellers, prices tend to rise, and when there are more sellers than buyers, prices tend to fall.

Another important aspect to consider is market liquidity. Liquidity refers to the ease with which a financial instrument can be bought or sold without causing a significant impact on its price. Highly liquid markets, such as major currency pairs or blue-chip stocks, have a large number of buyers and sellers, making it easier to execute trades at desired prices.

Lastly, understanding different types of orders is crucial. Market orders are executed immediately at the current market price, while limit orders allow you to set a specific price at which you’re willing to buy or sell. Stop orders, on the other hand, are used to limit potential losses by automatically triggering a trade when a certain price level is reached.

Now that you have a basic understanding of trading, let’s move on to setting financial goals for your trading journey.

Setting Financial Goals for Trading

Setting clear and realistic financial goals is a crucial step in trading. Before entering the market, it’s important to define what you want to achieve and how much risk you’re willing to take.

Start by assessing your financial situation and determining how much capital you can allocate to trading. It’s advisable to only use risk capital, which is money you can afford to lose without affecting your financial well-being. Trading with money you can’t afford to lose can lead to emotional decision-making and poor risk management.

Next, set specific and measurable financial goals. For example, you might aim to achieve a certain percentage return on your investment within a specific time frame. It’s important to set goals that are challenging yet attainable, as overly ambitious goals can lead to frustration and disappointment.

Additionally, consider your risk tolerance when setting financial goals. Some individuals are more comfortable taking on higher levels of risk in exchange for potentially higher returns, while others prefer a more conservative approach. Understanding your risk tolerance will help you determine the appropriate trading strategies and instruments to pursue.

Remember to regularly review and adjust your financial goals as your trading journey progresses. Markets are dynamic, and it’s important to adapt your goals based on changing market conditions and personal circumstances.

Now that you have defined your financial goals, let’s explore how to choose the right trading platform.

Choosing the Right Trading Platform

Selecting the right trading platform is essential for a smooth and successful trading experience. A trading platform is a software that allows you to access the financial markets and execute trades. Here are some factors to consider when choosing a trading platform:

- User-friendly interface: Look for a platform that is intuitive and easy to navigate. A cluttered or complex interface can hinder your trading efficiency.

- Available markets: Ensure that the platform provides access to the markets you’re interested in trading. Whether it’s stocks, forex, cryptocurrencies, or commodities, make sure the platform offers a wide range of instruments.

- Real-time data and analysis tools: Timely and accurate market data is crucial for making informed trading decisions. Look for a platform that provides real-time quotes, charts, and technical analysis tools.

- Order execution: A reliable trading platform should offer fast and efficient order execution. Delayed or unreliable order execution can result in missed trading opportunities or slippage.

- Security and regulation: It’s important to choose a platform that is regulated by a reputable financial authority. This ensures that your funds are protected and that the platform operates in accordance with industry standards.

- Customer support: Consider the availability and quality of customer support provided by the platform. In case you encounter any issues or have questions, responsive and knowledgeable support can be invaluable.

Once you have selected a trading platform, it’s time to develop a trading strategy.

Developing a Trading Strategy

A trading strategy is a set of rules and guidelines that govern your trading decisions. It helps you identify potential trade setups, determine entry and exit points, and manage risk effectively. Here are the key steps to developing a trading strategy:

- Define your trading style: Are you a day trader, swing trader, or long-term investor? Determine the timeframe you’re comfortable trading in, as this will influence the type of analysis and trading strategies you employ.

- Choose your analysis approach: There are two main approaches to analyze the markets: technical analysis and fundamental analysis. Technical analysis involves studying price charts and patterns to predict future price movements, while fundamental analysis focuses on analyzing economic, financial, and geopolitical factors that influence market prices.

- Identify trade setups: Based on your chosen analysis approach, look for specific trade setups that align with your trading style. For example, if you’re a technical trader, you might look for chart patterns, support and resistance levels, or indicators signaling potential trend reversals.

- Set entry and exit criteria: Determine the criteria that will trigger your entry into a trade and the conditions that will signal an exit. This can include specific price levels, indicator crossovers, or fundamental events.

- Implement risk management strategies: Successful trading requires effective risk management. Determine how much capital you’re willing to risk per trade, set stop-loss orders to limit potential losses, and establish profit targets to secure profits.

- Backtest and refine your strategy: Before trading with real money, it’s advisable to backtest your strategy using historical data. This allows you to assess its performance and make necessary adjustments. Refine your strategy based on the backtesting results and continue to monitor its performance in real-time trading.

Remember, developing a trading strategy is an iterative process. It requires continuous learning, adaptation, and refinement based on market conditions and personal experience. Now let’s explore how to manage risk effectively in trading.

Managing Risk in Trading

Risk management is a crucial aspect of successful trading. Proper risk management helps protect your capital and ensures that losses are kept under control. Here are some key principles of effective risk management:

- Determine your risk tolerance: Assess how much risk you’re comfortable with and set a maximum risk limit per trade. A common rule of thumb is to risk no more than 1-2% of your trading capital on any single trade.

- Use stop-loss orders: A stop-loss order is a predetermined price level at which your trade will be automatically closed to limit potential losses. Always set a stop-loss order when entering a trade to protect against adverse market movements.

- Diversify your portfolio: Avoid putting all your eggs in one basket by diversifying your trades. Investing in a variety of instruments across different markets can help spread risk and reduce exposure to any single trade or market.

- Avoid overtrading: Overtrading, or excessively frequent trading, can lead to increased transaction costs and emotional decision-making. Stick to your trading strategy and only take trades that meet your predefined criteria.

- Keep emotions in check: Emotions can cloud judgment and lead to impulsive trading decisions. Maintain discipline and stick to your trading plan, even in the face of market fluctuations.

- Regularly review and adjust risk management strategies: As your trading journey progresses, periodically review and adjust your risk management strategies. Market conditions and personal circumstances can change, requiring adjustments to your risk tolerance, position sizing, or stop-loss levels.

Effective risk management is a continuous process that requires discipline and self-control. By managing risk effectively, you can protect your capital and increase your chances of long-term trading success. Now let’s delve into the world of technical analysis for trading.

Technical Analysis for Trading

Technical analysis is a popular approach used by traders to forecast future price movements based on historical price data and patterns. It involves studying charts, indicators, and other graphical representations of price to identify potential trade opportunities. Here are some key concepts and tools used in technical analysis:

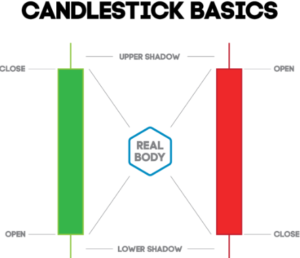

- Candlestick charts: Candlestick charts display price information in a graphical format, making it easier to identify patterns and trends. Each candlestick represents a specific time period and provides information about the opening, closing, high, and low prices.

- Support and resistance levels: Support levels are price levels at which buying pressure is expected to be strong enough to prevent further price declines. Resistance levels, on the other hand, are price levels at which selling pressure is expected to be strong enough to prevent further price increases. Identifying support and resistance levels can help determine entry and exit points.

- Trend lines: Trend lines are diagonal lines drawn on a chart to connect consecutive highs or lows. They help identify the direction and strength of a trend. An upward trend is characterized by higher highs and higher lows, while a downward trend is characterized by lower highs and lower lows.

- Indicators: Technical indicators are mathematical calculations based on price and volume data. They help traders identify potential trend reversals, overbought or oversold conditions, and other trading signals. Common indicators include moving averages, oscillators, and momentum indicators.

- Chart patterns: Chart patterns are recurring formations that can provide insights into future price movements. Examples of chart patterns include head and shoulders, double tops and bottoms, triangles, and flags. These patterns can help identify potential trend continuations or reversals.

It’s important to note that technical analysis is not foolproof and should be used in conjunction with other analysis techniques. Now let’s explore fundamental analysis, another approach used by traders to assess the value of financial instruments.

Fundamental Analysis for Trading

Fundamental analysis involves evaluating the intrinsic value of a financial instrument by analyzing economic, financial, and geopolitical factors that can influence its price. It focuses on understanding the underlying factors that drive supply and demand dynamics in the market. Here are some key concepts and tools used in fundamental analysis:

- Economic indicators: Economic indicators, such as GDP growth, inflation rates, interest rates, and employment data, provide insights into the health and performance of an economy. Traders analyze these indicators to assess the potential impact on the value of currencies, stocks, and other financial instruments.

- Company financial statements: For stocks, fundamental analysis involves analyzing a company’s financial statements, such as the balance sheet, income statement, and cash flow statement. These statements provide information about the company’s financial performance, profitability, and ability to generate cash flow.

- Industry analysis: Understanding the dynamics of the industry in which a company operates is crucial for fundamental analysis. Factors such as market competition, regulatory environment, and technological advancements can influence the long-term prospects and profitability of a company.

- Geopolitical events: Geopolitical events, such as elections, geopolitical tensions, and policy changes, can have a significant impact on financial markets. Traders analyze these events to assess their potential impact on currencies, commodities, and other instruments.

Fundamental analysis requires a deep understanding of the underlying factors that drive market movements. It is often used by long-term investors to make informed investment decisions. Now, let’s explore the importance of trading psychology and mindset.

Trading Psychology and Mindset

Trading psychology plays a crucial role in the success of traders. It refers to the emotions, attitudes, and mental state that influence trading decisions. Here are some key psychological factors to consider:

- Emotional control: Emotions such as fear, greed, and impatience can cloud judgment and lead to irrational trading decisions. Developing emotional control is essential for making objective and rational trading decisions.

- Discipline and patience: Successful traders exhibit discipline and patience by sticking to their trading plan and waiting for high-probability trade setups. Impulsive trading and deviating from the trading plan can lead to poor results.

- Risk tolerance: Understanding and accepting your risk tolerance is crucial for maintaining a healthy trading mindset. Avoid taking on excessive risk or letting fear prevent you from taking necessary trades.

- Learning and adaptability: The market is constantly evolving, and traders need to continuously learn and adapt to changing market conditions. Being open to new ideas and strategies can enhance trading performance.

- Maintaining a positive mindset: Trading can be challenging, and losses are a part of the game. Maintaining a positive mindset and learning from mistakes is essential for long-term success.

Developing a strong trading psychology and mindset takes time and practice. It’s important to be aware of your emotions and thought patterns and work on improving them. Now, let’s explore how to evaluate and adjust your trading strategy.

Evaluating and Adjusting Your Trading Strategy

Regularly evaluating and adjusting your trading strategy is crucial for long-term success. Markets are dynamic, and what works today may not work tomorrow. Here are some key steps to evaluate and adjust your trading strategy:

- Assess performance: Review your trading results and assess your performance against your predefined goals. Analyze your win rate, average profit and loss, risk-reward ratio, and other relevant metrics. This will help you identify areas for improvement.

- Identify strengths and weaknesses: Determine the strengths and weaknesses of your trading strategy. Identify the aspects that have been working well and those that need improvement. This can involve analyzing specific trades, reviewing your risk management strategies, or evaluating your analysis techniques.

- Make necessary adjustments: Based on your assessment, make necessary adjustments to your trading strategy. This can involve refining your entry and exit criteria, adjusting position sizes, incorporating new information, and reassessing risk management techniques. Stay informed about market trends, economic indicators, and any news that may impact your assets. Regularly review and update your trading plan to adapt to changing market conditions.

Resources for beginner traders

- Trade Brains: Trade Brains is a website that offers a comprehensive guide on the Indian stock market, including tips, strategies, and risk management techniques. They also have a YouTube channel with over 1.5 million subscribers that provides educational videos on investing, stock analysis, mutual funds, and behavioral finance.

- Shoonya Blog: Shoonya Blog provides a beginner’s guide to trading stocks in India. The guide walks you through the process of how you can learn to trade stocks, provides insights into the primary and secondary markets, recommends essential Indian stock market books for beginners, and offers valuable inputs on how to start trading stocks effectively.

- TradeSmart Online: TradeSmart Online offers a range of courses for beginners in the Indian stock market. The courses cover topics such as technical analysis, fundamental analysis, and derivatives trading. They also provide a free online course on the basics of the stock market.